Director: Ante Biluš

Ulica grada Vukovara 72, 10000 Zagreb

tel: ++385 1 6345 455, fax: ++385 1 6345 452

e-mail contact

ROLE, COMPETENCE, POWERS AND RESOURCES OF AMLO

The AMLO, in accordance with the international standards, is a central national center for collecting, analyzing and disseminating AML/CTF data to the competent authorities, and performs the following activities according to the Law and international standards:

AMLO is established according to AMLCFT Law, as special and operational independent unit within Ministry of Finance.

Once a year Ministry of Finance submitts the Annual report on AMLO work to the Government of the Republic of Croatia – Annual report on the AMLO work – 2011.

Croatian Parliament adopted the new Anti-Money Laundering and Terrorism Financing Law on 27 October 2017 and it was published in the Official Gazette No 108/17.

Consequently, Croatian legislation is harmonised with Directive (EU) 2015/849 of the European Parliament and of the Council of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing (4th EU AML Directive) and FATF (2012) Recommendations.

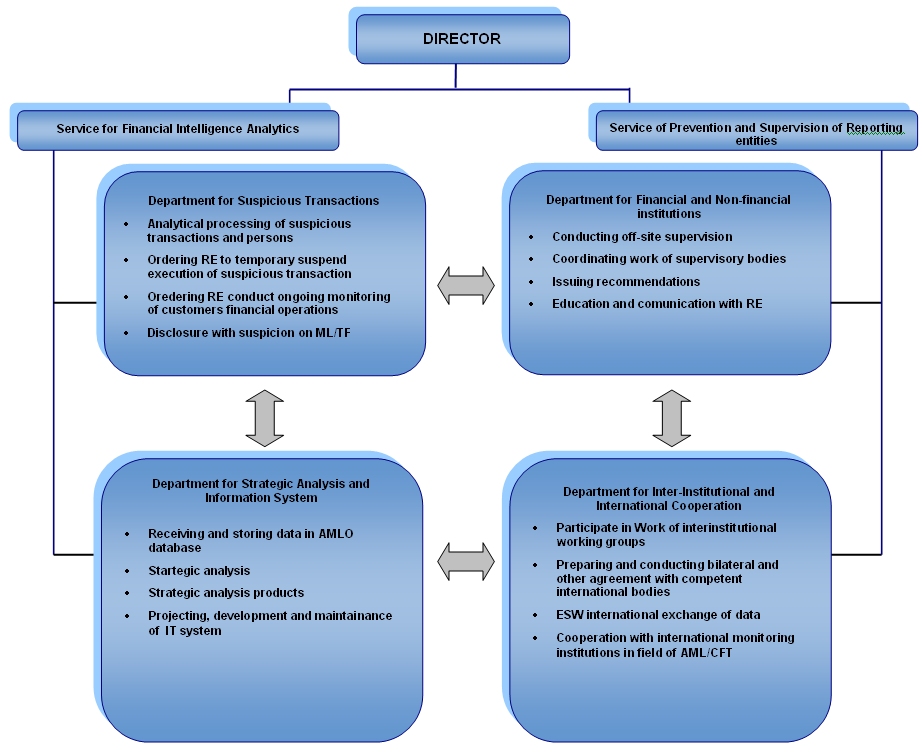

ORGANIZATION STRUCTURE:

1. Service for Financial Intelligence Analytics

a. Department for Suspicious Transactions

b. Department for Strategic Analysis and Information System

2. Service for Prevention and Supervision of Reporting entities

a. Department for Financial and Non-financial institutions

b. Department for Inter-Institutional and International Coperation

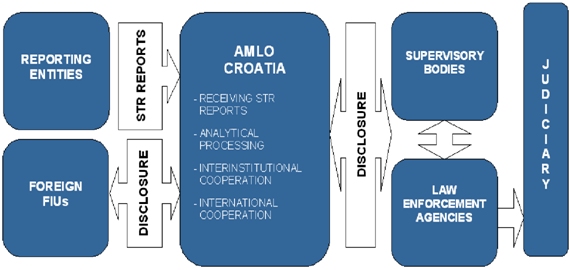

AML/CFT SYSTEM IN THE REPUBLIC OF CROATIA

Graphic overview:

AMLTF Law and international standards define the money laundering and terrorist financing prevention system as the scope of competence of not only one institution, but a system with legally defined roles of each participant and their mutual interaction and cooperation.

AMLO is just one link in the chain of money laundering and terrorist financing prevention system, which can fully contribute to prevention of use of the financial system of Republic of Croatia for money laundering and terrorist financing only through interactive cooperation with other competent authorities (State Attorney's Office, USKOK, Police, Security Intelligence Agency (SOA), CNB, CFSSA and supervisory services of the Ministry of Finance) and foreign FIUs.

Reporting entities (Art 4 (2) AMLTF Law: banks, savings banks, credit unions, authorised exchange offices, insurance companies, organisers of games of chance, brokerages, lawyers, notaries public, tax advisors and others.

The key element of prevention system is the obligation of banks and other reporting entities obliged by the Law for reporting the AMLO on:

Supervisory bodies (Art 83 AMLTF Law): conduct supervision over the reporting entities concerning the implementation of money laundering and terrorist financing prevention measures:

a) the Croatian National Bank,

b) the Croatian Financial Services Supervisory Agency,

c) the Financial Inspectorate of the Republic of Croatia,

d) the Tax Administration.

The Croatian National Bank: conducts supervision of compliance with the Law with banks and other credit institutions.

The Croatian Financial Services Supervisory Agency (CFSSA, HANFA): conducts supervision of compliance with the Law with capital markets participants, funds and insurance companies etc.

The Financial Inspectorate: conducts supervision of compliance with the Law, as the primary supervisor, with the sector of so called non-bank financial institutions (exchange offices, money transfer services, etc.), and professional activities sector (lawyers, notaries public, accountants, auditors, tax advisers).

The Tax Administration: conducts supervision of compliance with the Law with the organisers of games of chance. The Tax Administration also checks domestic legal and natural persons’ compliance with the prescribed limitation of cash payments in an amount exceeding HRK 105,000.00, i.e. amount exceeding EUR 15,000.00 in the arrangements with non-residents.

The Customs Administration: conducts controll of cash transfer across the state border.

Financial intelligence unit:

AMLO: as the central national body in charge for receiving, analysing and disseminating to competent bodies cases with suspicion of ML/TF is a part of the preventive system, an intermediary body, between financial and non-financial sector (banks and others), which report suspicious transactions to the AMLO, on the one hand, and prosecution bodies (police and State Attorney’s Offices), as well as courts, on the other.

LEAs

Police: conducts police inquiries and financial investigations of money laundering criminal offences by acting on cases initiated from the AMLO, from other supervision bodies, or on its own initiative.

Prosecutor

State Attorney: directs the work of the police in treatment of money laundering cases received from the AMLO and other bodies in the ML/TF prevention system, and coordinates work of other competent bodies.

Courts: at the court are conducted criminal proceedings for the criminal offence of money laundering and confiscation of proceeds, initiated by all the competent authorities from the ML/TF prevention system.

Accordingly, the AMLO, above all, represents a part of the prevention system, which has primary responsibility to prevent use of the financial system for money laundering and terrorist financing purposes. Therefore, the AMLO is not the investigative body competent for conducting financial investigations, nor the inspection body which conducts direct supervision over reporting entities by the Law (AMLO conducts only off-site supervision according to Art 84 of AMLTF Law), because according to the Law and international standards, other bodies, namely prosecution bodies and supervision bodies in the ML/TF prevention system, are responsible for the enforcement of these actions.